Simplifying GSTR 6 Automation with EaseMyGST for Input Tax Distribution

Streamlining GSTR 6 Filing with EaseMyGST

As businesses expand their reach across the nation, the complexities of GST compliance grow in tandem. One of the key challenges faced by businesses is filing the GSTR 6 return, a monthly GST requirement for Input Service Distributors (ISDs). In this blog, we'll delve into how EaseMyGST transforms the process of GSTR 6 filing, automating the distribution of input tax credit.

Understanding the Input Service Distributor (ISD) Concept

The Input Service Distributor (ISD) concept, inherited from the Service Tax Regime, plays a pivotal role in streamlining GST compliance. An ISD acts as the central hub for managing common expenditures and billings across an organization's branches and sub-units registered under the same PAN. By doing so, the ISD simplifies the credit-taking process and facilitates the smooth flow of credit under GST.

Unveiling the Essentials of GSTR 6: Why, When & Who

Why File GSTR 6: GSTR 6 contains crucial details about the distribution of Input Tax Credit and tax invoices among service recipients. Even if it's a nil return, every ISD is mandated to file GSTR 6.

When to File: As per the GST Act, GSTR 6 must be filed by the 13th of the following month.

Who Should File: GSTR 6 filing is obligatory for every Input Service Distributor.

Preparations Before Filing GSTR 6: 11 Key Points

1. ISD's Prime Role: ISD receives invoices for services utilized by its branches/sub-units under the same PAN.

2. Dual Role of ISD: Centralizing billing/payment for common expenses and distributing CGST/SGST/IGST/UTGST tax credit to service recipients.

3. Registration Process: To distribute credit, register as an "ISD" under serial number 14 of the REG-01 form.

4. Limited Distribution: ITC can only be distributed to branches under the same PAN, with varying GSTINs.

5. Exclusions: ISD cannot distribute credit for services used by outsourced manufacturers or service providers.

6. Credit Limitation: Distribution must not exceed the tax amount paid for the services.

7. Input Goods Exemption: ISD doesn't cover ITC paid on input goods like raw materials and capital goods.

8. Unique Limitation: Unlike regular taxpayers, ISDs can't claim credit for taxes paid on services.

9. GSTR 3B Exemption: ISDs don't file GSTR 3B since they lack their own liability and credits.

10. Nil Returns Inclusion: GSTR 6 filing is mandatory, even for nil returns.

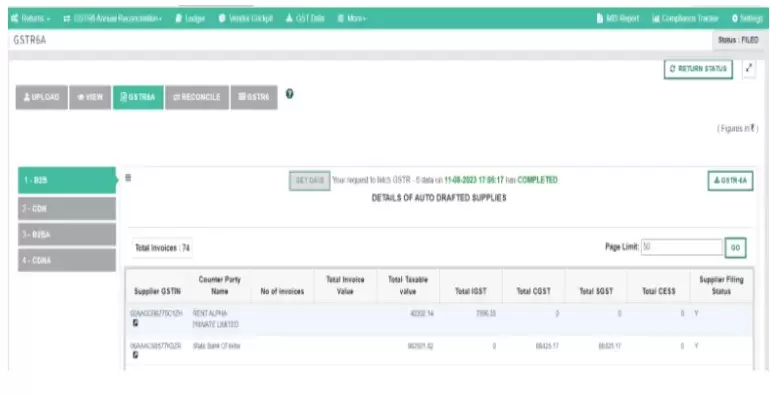

11. GSTR 6A: A read-only form generated from vendor invoices in GSTR-1.

Effortless GSTR6 Reconciliation with EaseMyGST

EaseMyGST simplifies reconciliation through automatic triggering. The comparison of GSTR 6A and EaseMyGST-uploaded data identifies discrepancies. Reconciled invoices are displayed in separate sections for detailed review. Cross-utilization of ITC is facilitated, calculated via the GSTN API. For comparing invoices, the following fields are considered

1. GSTIN of counter-parties

2. Invoice number (Not case sensitive)

If the fields match, then the invoices will be compared.

Section Wise View

Consolidated View

A consolidated view can be obtained by clicking on multiple sections. You can download the data section-wise or consolidated.

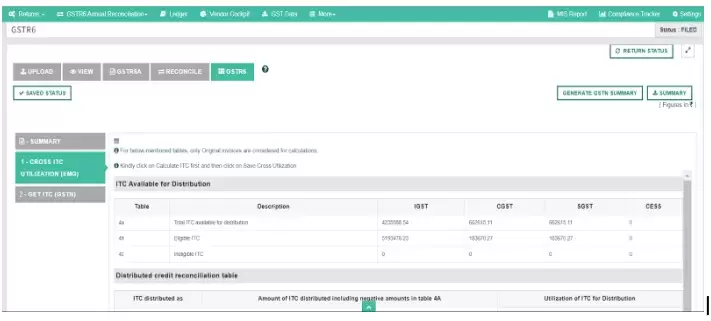

Navigating Cross ITC Utilization with EaseMyGST

Cross ITC utilization is made efficient with EaseMyGST. After recording regular transactions and ISD invoices, users access the ITC utilization tab. EaseMyGST calculates the cross ITC utilization table based on saved invoices and available ITC.

4a – This shows total ITC available for distribution based on regular transaction and ISD credit notes

4b – It shows the eligible ITC calculated based on ISD invoices with the description as eligible

4c – It shows the ineligible ITC calculated based on ISD invoices with the description as ineligible

Image: ITC Available for Distribution

EaseMyGST will calculate aggregated level cross-utilization ITC details based on invoice level ITC utilization details provided by you for ISD invoices.

Now after reviewing calculations, click on calculate ITC and then click on save cross-utilization button.

This will save your Input Tax Credit data on the GSTN portal. Also if you get any error while saving these details , you need to rectify the error and save the invoice again. Then try to save cross-utilization again.

Note the following points

- Invoices having errors or mark as deletion will not get considered

- Amended invoices are not considered in this calculation. If you have amended invoices then kindly go to GSTN portal and add cross-utilization details and save it on GSTN portal

- Also if there is only negative ITC available, then for distribution kindly go to the GSTN portal.

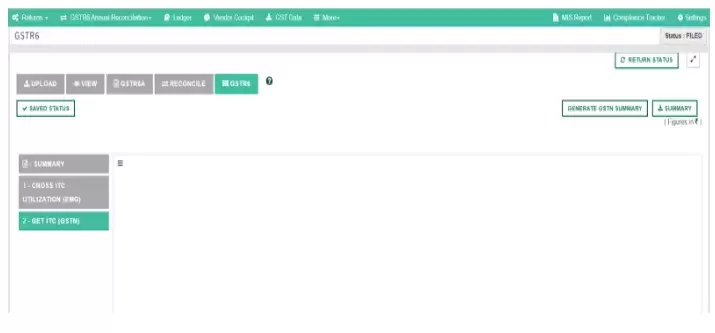

Final Checks and Submission

Reviewing ITC calculations, users can save cross-utilization data on the GSTN portal. Errors are highlighted, rectified, and resubmitted. To verify ITC details, the "Get ITC" tab offers data saved on the GSTN portal. For submission and filing, users proceed to the GSTN portal.

Image: Get ITC for GSTR6

Conclusion: GSTR 6 Simplified with EaseMyGST

EaseMyGST revolutionizes GSTR 6 filing, transforming the distribution of input tax credit through automated reconciliation and cross ITC utilization. By embracing this powerful tool, businesses can navigate the complex landscape of GST compliance seamlessly, ensuring accurate filing and enhanced efficiency.