Maximize Your ITC (Input Tax Credit) Claim: Here are 4 things you need to do!

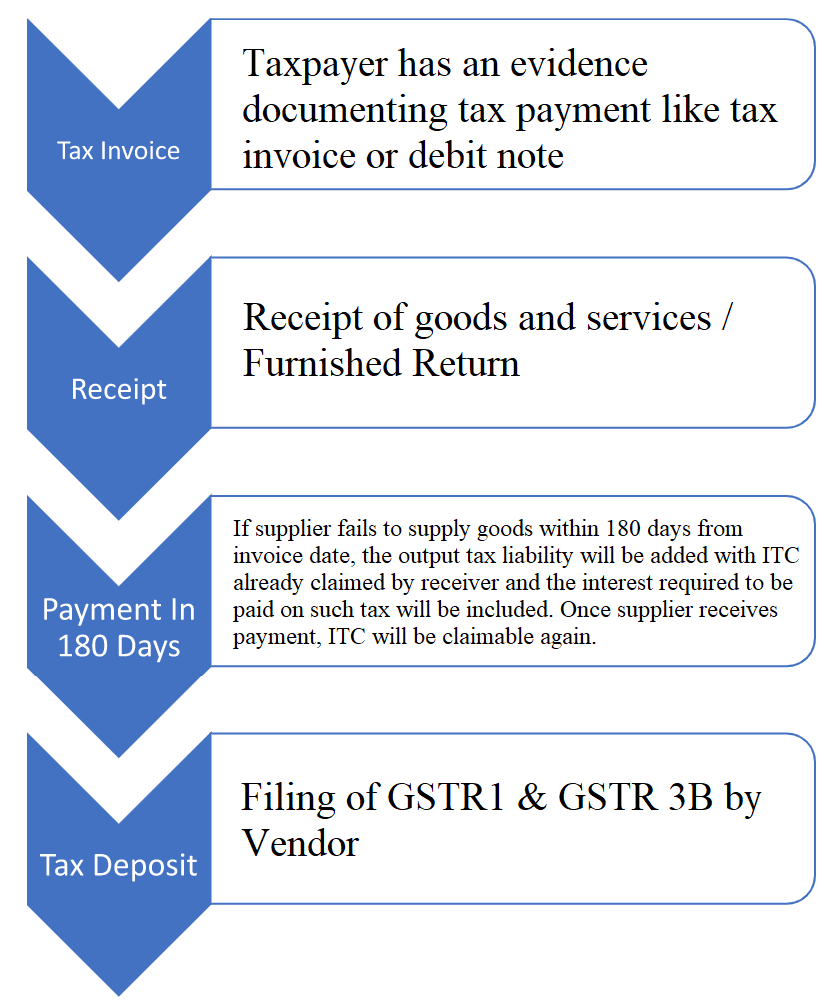

The ultimate objective of every taxpayer is to maximize their input tax credit or ITC while following all the conditions and rules of GST law. These conditions are:

The success of this activity depends on the internal practices and tools used and some external factors such as vendor compliance. In this article, we will discuss four important aspects to maximize ITC claim.

4.1. Internal Processes and Controls

Keeping in view the provisions of the law, there are various steps and events that taxpayers need to track which can help timely and correct computation of input tax credit that can be claimed. As mentioned earlier, ITC computation not only needs data from the GST system i.e. GSTR 2A and GSTR 2B but also additional information that is available in the accounting or ERP systems. Some of the key points are listed below:

- Defining processes and validations: Tracking the checkpoints such as receipt of invoice and receipt of goods, or in case of goods received in batches, the receipt of the last lot of the goods is a good practice. Being one of the prerequisites for ITC claim, meeting these conditions is necessary.

- Maintaining Products & Services Masters: The Negative List for ITC is dependent on the business of the taxpayers. Hence maintaining a product and services master to indicate whether or not some items are included in the negative list can help. Thus, at the time of capturing purchase transactions, such ineligible or blocked credit gets marked.

- Capturing Details at Invoice-level: Likewise, other additional information such as type of goods – input/capital, the purpose of the transaction – business, non-business etc., will help in automating the ITC computation as well as keep a check on transactions which are to be excluded in ITC Computation.

- Highlighting exceptions: Internal processes and systems should have mechanisms to identify events that are related to the reversal of ITC such as payment terms and status of invoices, depreciation accounting etc. Highlighting abnormalities and exceptions within the stipulated time so as to avoid reversal of ITC claimed earlier related to such invoices.

- Automating Invoicing: 80% of the time, businesses deal with same vendors every month with a set pattern of products transacted. Hence, it is always advisable to automate the recording of supplier invoices for data like GSTIN, product quantity, product codes etc. that can ensure accuracy and hence lesser amendment troubles.

4.2. Robust GST Reconciliation

All this time, while the ITC computation was more of an internal process, with GST and the changing rules, the dependency of ITC computation has grown on external data sources i.e. reporting of invoices by vendors on the GST portal.

For the Government, the data reported by vendors is the basis for monitoring ITC claims by the recipient. Hence, it becomes essential to compare and match the internal and external versions of the same data.

In other words, GST Reconciliation is more of a need than a choice to maximize ITC claims.

4.3. Comprehensive Reports

After reconciliation, the next thing required is a neat and meaningful compilation of the results to deep dive into the transactions that need attention.

Deriving insights and analysing the same data from different perspectives is the pressing need, so as to achieve the goal of maximising ITC claim. Also, given that a business entity could have many GST registrations, getting a group-level view with an option to drill down to the GSTIN level is a desirable option to have.

The GST MIS report is an additional feature that enables top management or decision-makers to quickly assess the compliance level. MIS reports will offer a thorough analysis of mismatches, total GST turnover, maximum ITC utilisation, and other decision-making criteria.

GST MIS reports offers a comprehensive understanding of the firm’s GST compliance status and other GST-related issues, enabling teams to make timely, informed decisions that will either prevent the company from suffering losses or open up new revenue streams.

Some MIS Reports which could be extremely useful are –

- Summary of reconciliation results at the group level

- Cross-GSTIN invoices within the PAN

- Categorisation of invoices based on eligibility for ITC

- Invoices where ITC has been claimed provisionally

- Vendor-wise reconciliation summary

4.4. Keeping a Check on Vendor Compliance

Be it internal processes or any GST solution that you are using for reconciliation and ITC tracking, it is ineffective if it does not support mechanisms to know and track vendor compliance.

With the Government tightening its norms, not only is the claim from a non-compliant vendor blocked, but other operational activities such as e-way bill generation also get adversely impacted.

For all your vendors in the purchaser register, you need to know whether the returns GSTR 1 and GSTR 3B have been filed. Not only the filing status but filing frequency of GSTR 1 also should be known.

If you have vendors who have opted for quarterly filing of GSTR 1, then the invoices may be reflected at the GST portal on a quarterly basis which will affect your ITC claim. The government has provided a facility to search the compliance history of any taxpayer and filing status is also made available as part of GSTR 2A.

To know more check out the GST software page.