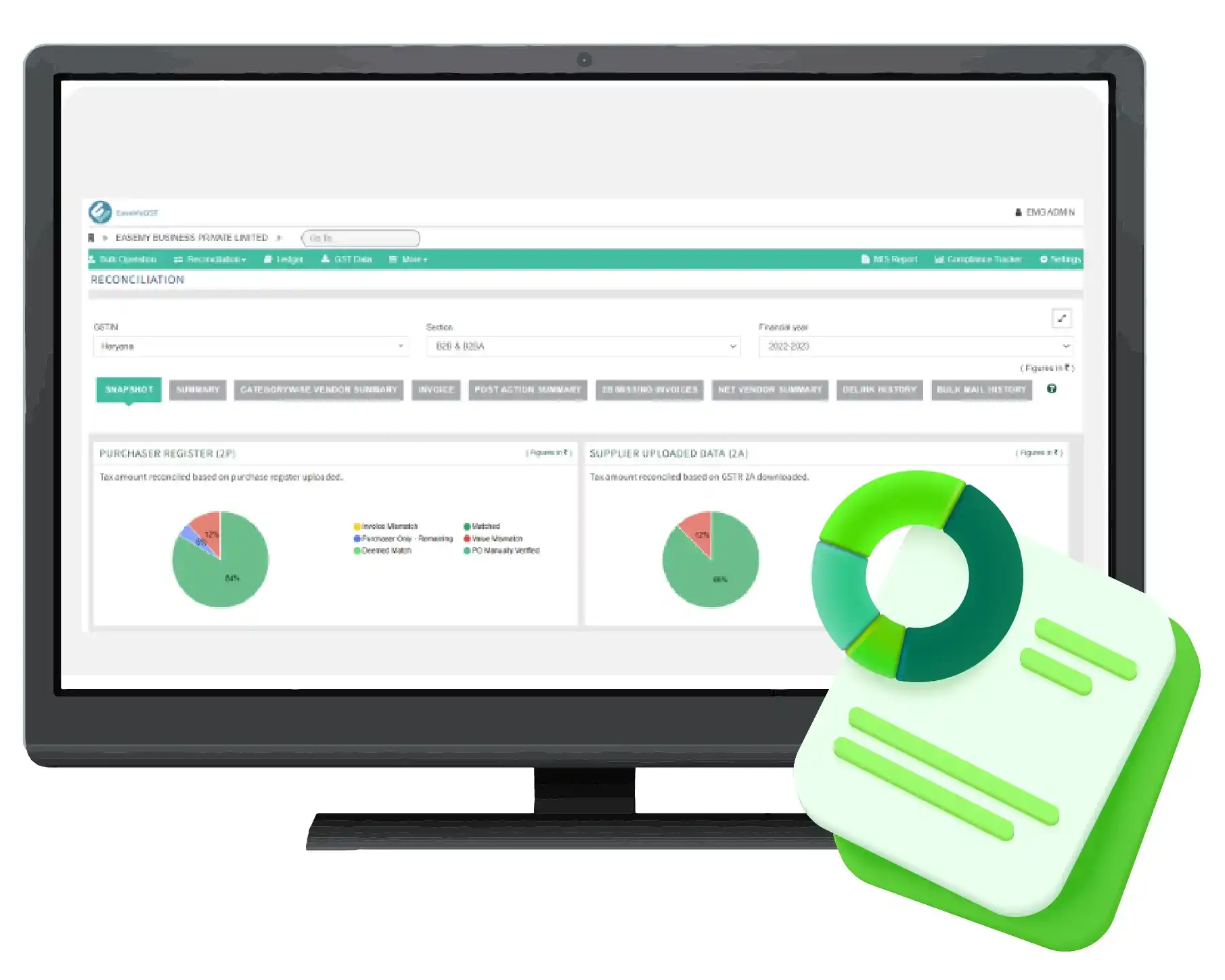

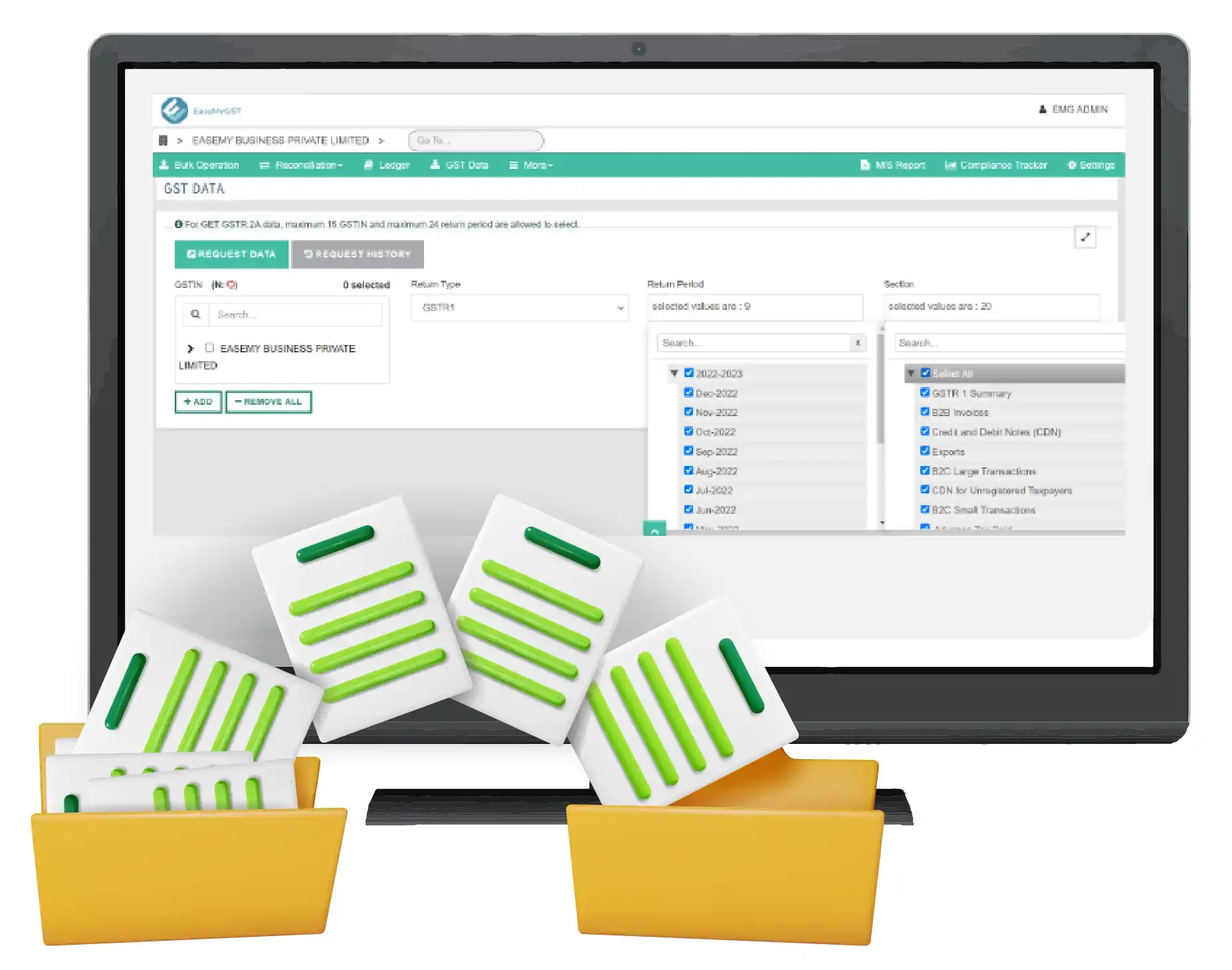

GST reconciliation is the process of matching your business purchase data with the invoices raised by suppliers and to match your sales with your customers’ purchases. It sounds simple right? But it is very tedious and time-consuming if it is done manually or in Excel. This GST reconciliation can be fully automated using the options in the reconciliation module of EaseMyGST.

Read on to find out how the reconciliation module helps you avoid GST scrutiny, ITC losses and suspension of GST registration all while saving you time and effort.

.png)