Input Format for GSTR 1 & GSTR 2

GSTR-1 and GSTR-2 are two important returns that need to be filed by registered taxpayers in India under the Goods and Services Tax (GST) system.

The format for filing GSTR-1 includes the following tables is quite lengthy and if prepared manually in Excel would be error-prone, time-taking and quite difficult to do. We suggest using GST software like EaseMyGST to automate the entire process of GSTR1 and GSTR2 returns.

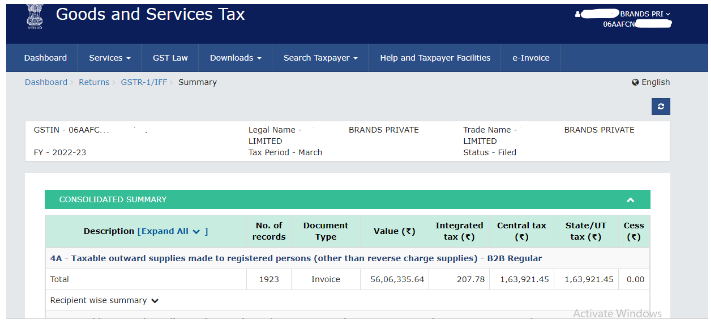

Table 1: Basic details such as GSTIN, legal name, and trade name of the taxpayer.

Table 2: Details of all outward supplies made to registered persons (B2B).

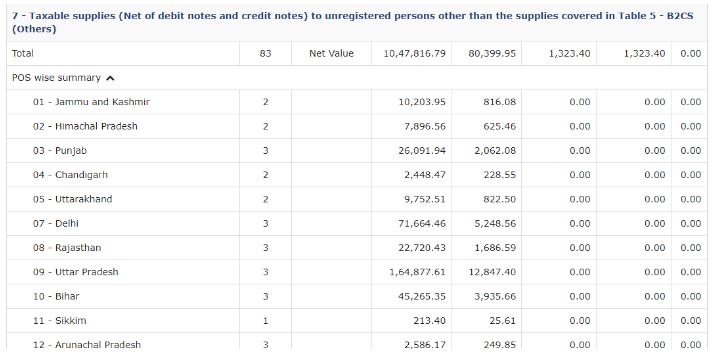

Table 3: Details of all outward supplies made to unregistered persons (B2C).

Table 4: Details of credit/debit notes issued during the tax period.

Table 5: Details of advances received against a supply to be made in the future.

Table 6: Details of inward supplies made from an ISD (Input Service Distributor).

Table 7: Details of tax liability on outward supplies.

Table 8: Details of tax paid.

Table 9: Details of tax liability and payment related to the previous tax period.

The format for filing GSTR-2 includes the following tables:

Table 1: Basic details such as GSTIN, legal name, and trade name of the taxpayer.

Table 2: Details of all inward supplies received from registered persons (B2B).

Table 3: Details of all inward supplies received from a registered person under the reverse charge mechanism (RCM).

Table 4: Details of credit/debit notes received during the tax period.

Table 5: Details of advances paid against a supply to be received in the future.

Table 6: Details of input tax credit (ITC) received.

Table 7: Details of ITC reversed or reclaimed.

Table 8: Details of ITC ineligible.

Table 9: Details of tax liability and payment related to the previous tax period.

Through EaseMyGST users can prepare the data through ready API connectors where all the data will automatically be uploaded in the correct format.