Input Service Distributor (ISD) under GST Compliance, ITC Distribution & GSTR-6 Filing

ISD or an Input Service Distributor is a type of taxpayer under GST who needs to distribute the GST input tax credits that pertain to its GSTIN to its units or branches having different GSTIN but registered under the same PAN. From 1st April, 2025, it is mandatory to get registered under GST as ISD and start complying with ITC distribution and GSTR-6 filing if your entity receives common input service invoices for multiple GSTINs.

Who is an Input Service Distributor (ISD) under GST?

An Input Service Distributor (ISD) is a taxpayer that receives invoices for services used by its branches. It distributes the tax paid, known as the Input Tax Credit (ITC), to such branches on a proportional basis by issuing ISD invoices. The branches can have different GSTINs but must have the same PAN as that of ISD.

Let’s understand with an example:

The head office of M/s ABC Limited is located in Bangalore having branches in Chennai, Mumbai and Kolkata. The head office incurred annual software maintenance expenses (service received) on behalf of all its branches and received the invoice for the same.

Since the software is used by all its branches, the input tax credit of entire services cannot be claimed in Bangalore. The same has to be distributed to all three locations. Here, the head office at Bangalore is the Input Service Distributor.

EaseMyGST offerings for ISD Filling

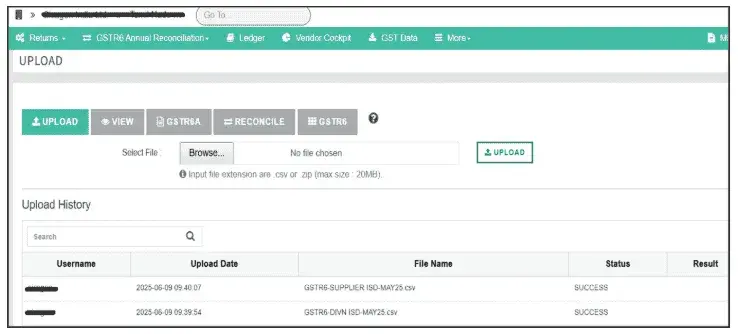

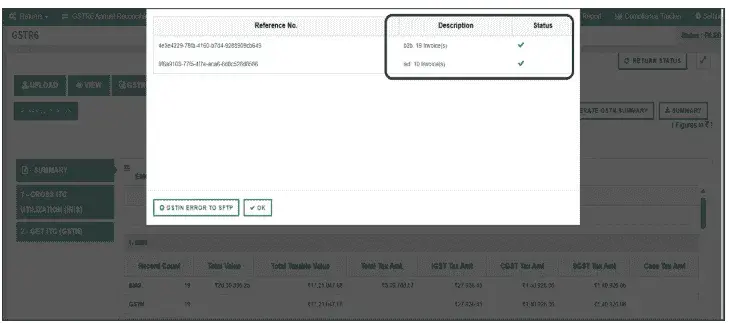

1. Sync or Upload Purchase Service invoice

A taxpayer can easily sync their Purchase service Invoice through their ERP or they can easily upload Excel into EaseMyGST.

2. Data Validation Assistance

Experts help in validating data before uploading to the government portal to ensure error-free filing.

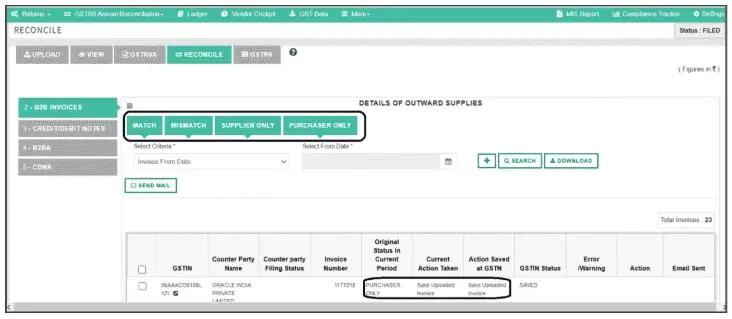

3. GSTR-6 vs GSTR-6A Reconciliation

Accurate reconciliation between GSTR-6A (auto-populated) and GSTR-6 (final return) for better compliance.

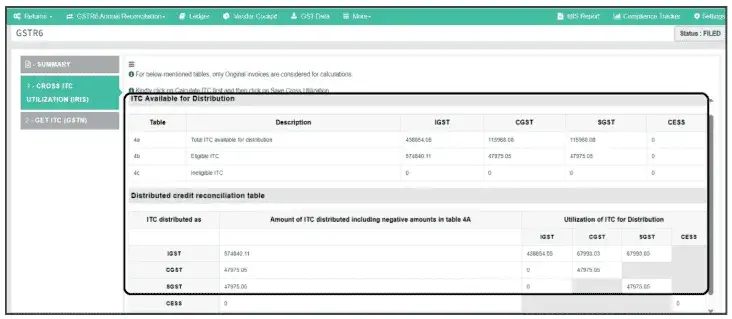

4. ITC Distribution Across Branches

Seamless support in distributing eligible Input Tax Credit (ITC) across branches under the same PAN, based on turnover ratio or service usage.

5. Auto Summary Creation of GSTR-6

EMG provides auto summary for Service Invoice as well as distribution & comparison between Upload & GSTIN Values.

6. Benefit of EMG-Ginesys Integration

Streamlined workflow with Ginesys integration ensures automated data flow, reducing manual errors and saving time during ISD return preparation.

Eligibility Criteria for ISD Registration under GST

An entity must register as an input service distributor (ISD) only if it is applicable. ISD registration under GST would be applicable to an entity if the below are satisfied:

- Must be an office supplying goods or services or both.

- Receiving tax invoices towards input services bought for or on behalf of its units/branches having different GSTINs but falling under the same PAN.

- Must be located at the place where the common input services are received.

- Can distribute ITC on input services as an ISD including those on which GST is paid under reverse charge mechanism.

- Can apply for multiple ISD registrations if common services are received at different offices located in different states or districts.

- Must begin issuing a prescribed ISD invoice document for distributing the input tax credit of CGST (or SGST in State Acts) and/or IGST paid on the said services to its unit/branch under the same PAN but with a different GSTIN.

Common Services where ISD is applicable

(i) Statutory Auditors Fee

(ii) Internal Auditors Fee

(iii) Company Secretary

(iv) Professional Fee to CA for Certification charges

(v) Security Services – [RCM]

(vi) Advocate Services [RCM]

(vii) Software Services

(viii) Sponsorship Services

(ix) Retainership fee

(x) Advertisement, Digital and Marketing Services

(xi) Lease Rent [RCM] and

(xii) Bank Charges [select transactions like Bank loan etc.,]

(xiii) Other common Services, if any

Situations where ISD is not Applicable

ISD cannot distribute the input tax credit in the following cases:

- Where ITC is paid on inputs and capital goods. For instance, raw materials and machinery purchased.

- ITC cannot be distributed to outsourced manufacturers or service providers.

Purpose of Registering as ISD

The concept of ISD is a facility made available to businesses having a large share of common expenditure and billing or payment is done from a centralised location. The mechanism is meant to simplify the credit taking process for entities and the facility will strengthen the seamless flow of credit under GST.

Conditions for Distribution of Input Tax Credit

- The Input Tax Credit (ITC) available for distribution in a month shall be distributed in the same month and details of the same shall be given in the form GSTR-6

- The credit of tax paid under the reverse charge mechanism u/s 9(3) and 9(4) shall also be distributed to the recipients by ISD.

- The tax credit available against any specific input services used entirely by one of the recipients can be allocated only to that recipient for utilisation of such credit and not to other recipients.

- The tax credit available against the input services used commonly by more than one recipients of the ISD shall be allocated to all such recipients that are operational during the year on a proportionate basis in the following ratio:

Ratio: Turnover in a State/ Union territory of such recipient, during the relevant period/ Aggregate of the turnover of all such recipients - The tax credit available against the input services used commonly by all the recipients of the ISD shall be allocated to all the recipients that are operational during the year on a proportionate basis in the following ratio:

Ratio: Turnover in a State/ Union territory of such recipient, during the relevant period/ Aggregate of the turnover of all such recipients

Conclusion

With ISD registration becoming mandatory from 1st April 2025, businesses must streamline their Input Tax Credit distribution and GSTR-6 compliance to avoid errors and penalties.

EaseMyGST (EMG) simplifies the entire process—from syncing invoices and validating data to seamless ITC allocation, reconciliation, and automated return preparation. By leveraging EMG’s integration and expert support, entities can ensure accurate, timely, and hassle-free ISD filings while maintaining a smooth flow of credit across branches.