5 Types of Audits Under GST Rules That You Must Know

The Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services in India. As part of the GST regime, audits play a vital role in ensuring compliance and transparency.

The GST law provides the following types of GST audits or reviews of your GST filings that need to be carried out on a regular basis and some that can be done on an ad-hoc basis under the discretion of the Tax department.

Understanding these audits for GST is crucial for businesses to navigate the complexities of GST and stay compliant with the regulations set by the government.

What is GST Audit

A GST audit or an audit under GST is an examination of a taxpayer's records, returns, and other documents to verify the correctness of turnover declared, taxes paid, refund claimed, and input tax credit availed, and to assess compliance with the provisions of the Goods and Services Tax (GST) law. It ensures transparency and accuracy in the GST framework by scrutinizing the financial statements and business operations of registered taxpayers.

Types of GST Audits

Let’s explore all the 5 types of audits under GST in detail, shedding light on their purpose, scope, and procedures. From the statutory audit that assesses the correctness of financial statements to the compliance audit that examines compliance with GST rules, each audit has a specific role in ensuring adherence to the GST framework.

By familiarizing yourself with these types of GST audits, you will gain valuable insights into the requirements, timelines, and best practices to mitigate the risk of non-compliance. This knowledge will empower you to maintain accurate records, make informed business decisions, and avoid penalties.

1. Departmental Audit/Audit by Tax Authorities

A Departmental Audit is a routine audit for GST that is conducted on a regular basis by the tax authorities.

In order to ensure a proper calculation and discharge of tax liability, the tax authorities have been authorized to conduct an audit of the records maintained by the taxpayer (GST-registered businesses).

As per section 65 and Rule 101(3) of GST Audit Rules, the commissioner or an officer authorized by him can conduct an audit and verify the details of the ‘records’ and the ‘books of account’ of the registered person/business, along with the assistance of a team of officers and officials accompanying him.

Key Points under Sec 65 & Rule 101(3) of GST Audit Rules:

- This type of GST audit shall be conducted at the place of business of the registered person or their registered office.

- An intimation of the audit shall be provided at least 15 days in advance in Form GST ADT-01. The audit is to be completed within three (3) months from the date of commencement.

P.S: In case GST officers need more time, the Commissioner can extend the periodicity of the audit, by a further period not exceeding six (6) months.

Furthermore, upon the conclusion of the audit, the authorized officer shall inform the findings, rights and obligations, and the reasons for the given findings to the registered person, within a period of 30 days in FORM GST ADT-02.

If the registered taxpayer is found at fault, such as wrongly availed/utilized ITC (Input Tax Credit), the authorized officer can proceed as per the procedure laid down under section 73 or Section 74.

2. Statutory Audit

This is a type of audit under GST rules which is required by law or statute for certain types of entities, such as public companies, government organizations, and other entities with specific regulatory requirements. As per Section 35(5) of GST Audit rules, a registered taxpayer with an aggregate turnover exceeding Rs 2 crores in a financial year was required (prior to 30 July 2021) to get his account books and returns audited by a professional chartered accountant. A certified copy of these audited accounts and a reconciliation statement were to be submitted in the form GSTR 9C via the common portal or through the Facilitation Centres as notified by the Commissioner.

However, from 30th July 2021 onwards, the government has notified the removal of GST audit and certification to be done by CA/CMA, and instead, a self-certified GSTR 9C is to be submitted from FY2020-21 onwards by the taxpayers.

3. Special Audit

As per section 66 and Rule 102 of GST Audit Rules, an authorized officer (not below the rank of Assistant Commissioner) at any stage of scrutiny, inquiry, or investigation may avail the services of a CA or CMA by considering the nature and complexity of the business and if the authorized officer is of the opinion that:

- Value has not been correctly declared; or

- The credit availed is not within the normal limits, the authorized officer shall issue the direction for the audit in Form GST ADT-03, wherein the registered dealer shall be required to get his records including his books of accounts to be examined and audited by the specified professional CA or CMA within a period of ninety (90) days from the day of passing such an order.

Key Points under section 66 and Rule 102 of GST Audit Rules:

- The expense of such special GST audits and examinations is paid by the commissioner.

- The period required to audit the account can be provided with an extension of additional ninety (90) days.

- Upon conclusion of the special GST audit, the findings are communicated to the auditee in Form GST ADT-04.

4. Limited scrutiny

A Limited Scrutiny is a type of audit under GST that is conducted in specific cases identified by the tax authorities where they suspect non-compliance with the provisions of the GST law. The objective of limited scrutiny is to verify compliance with the provisions of the GST law, including the correctness of the tax returns filed, payment of tax, and compliance with other provisions of the law.

5. Taxpayer-initiated audit

This is a type of audit under GST that is initiated by the taxpayer himself. The objective of a taxpayer-initiated audit is to verify compliance with the provisions of the GST law, including the correctness of the tax returns filed, payment of tax, and compliance with other provisions of the law.

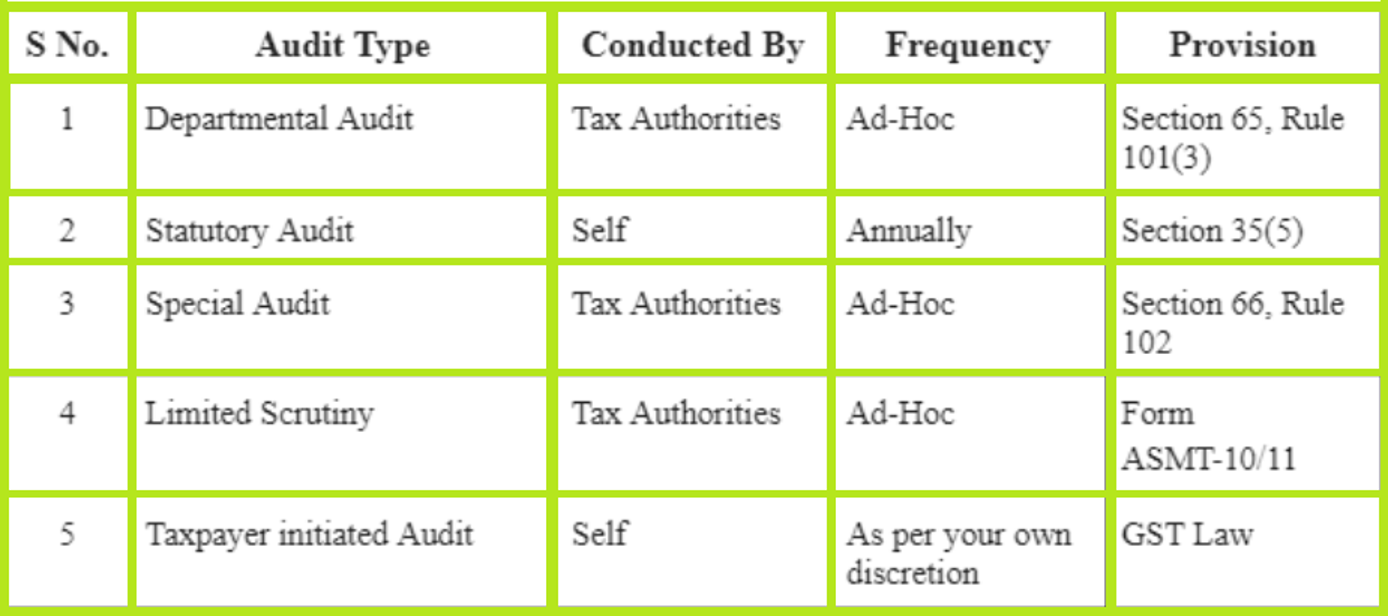

Summary:

Here is a review of the different types of audits conducted under the GST rules along with their nature:

In conclusion, understanding the five different types of audits under GST rules is essential for businesses operating in India. These audits for GST serve as crucial tools to ensure compliance, transparency, and accountability in the GST framework.

Taxpayers are advised to keep accurate and complete records of their business transactions, file their tax returns on a timely basis, and pay the tax due on time. The consequences of non-compliance with the provisions of the GST law are severe, including fines, penalties, and imprisonment. Therefore, it is important for taxpayers to ensure compliance with the provisions of the GST law, including compliance with the provisions related to audits. You may go through the EaseMyGST offering to ensure simple compliance with GST rules.