Benefits of the GST Data Connector for Ginesys ERP

A data connector is a tool or technology that facilitates the exchange of data between different systems, applications, or databases. Here are some key advantages of using data connectors:

Data Integration: Data connectors enable the seamless integration of data from diverse sources. They can connect to various databases, APIs, cloud services, and other data repositories, allowing organizations to consolidate and unify their data assets. This integration eliminates manual or Excel based bulk data management and enables a comprehensive view of the data, which is essential for accurate analysis and decision-making.

Automation and Efficiency: Data connectors automate the process of data extraction, transformation, and loading (ETL). They can retrieve data from multiple sources, apply necessary transformations, and load it into the target system or database automatically. This automation saves time and effort, reduces manual errors, and improves overall efficiency in managing and processing data.

Real-Time Data Access: Many data connectors support real-time data streaming, enabling organizations to access and analyze data as it is generated. This real-time capability is crucial for applications such as real-time analytics, monitoring systems, and live reporting.

Data Quality and Consistency: Data connectors often include features to ensure data quality and consistency. They can perform data validation, cleansing, and enrichment during the integration process. By applying data quality rules and transformations, connectors help maintain the accuracy, completeness, and reliability of the integrated data.

Cost Savings: Using data connectors can result in cost savings for organizations. By automating data integration and reducing manual effort, connectors free up resources and reduce operational costs. They also enable better data utilization and analysis, leading to improved decision-making and potentially generating cost-saving opportunities.

Overall, data connectors play a vital role in enabling efficient data integration, improving data quality, and facilitating real-time data access. By harnessing the power of connectors, organizations can gain valuable insights, drive innovation, and make data-driven decisions with confidence.

EaseMyGST with the assistance of the Ginesys technical has built quality connectors for the Ginesys ERP. Here are key features of the EaseMyGST GST connector which helps our Ginesys One suite Clients.

EaseMyGST Connector in Ginesys ERP

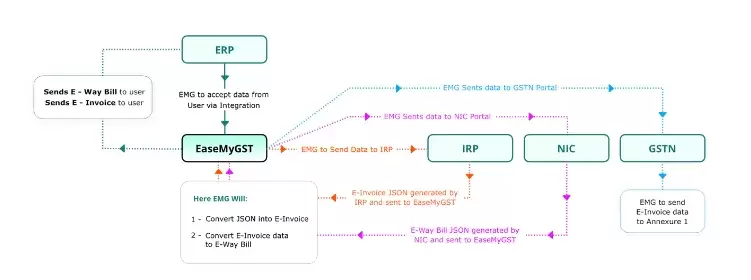

Here is the flow of data from Ginesys to EaseMyGST

Benefits for Ginesys ERP users with the EaseMyGST data connector for GST

- Automated GST Calculation

- Compliance with GST Regulations

- Seamless GST Filing

- Improved Efficiency

- Enhanced Accuracy

- Better Financial Insights

- Integration with Other Systems

Validations performed by EasyMyGST once data is received from Ginesys via the data connector

GSTIN Validation: GST Identification Number (GSTIN) is a unique identification number assigned to each registered taxpayer under GST. Validating the format and structure of a GSTIN ensures that it is a correctly formatted GST number.

HSN/SAC Validation: Harmonized System of Nomenclature (HSN) codes are used to classify goods and services for GST purposes. Service Accounting Codes (SAC) are used to classify services. Validating the HSN or SAC codes helps ensure accurate classification and appropriate tax treatment.

Invoice Number Validation: Verifying the format and uniqueness of invoice numbers issued by taxpayers is important for maintaining accurate records and preventing duplication.

Tax Rate Validation: Ensuring that the correct tax rates are applied to goods and services is crucial for accurate tax calculation and compliance. Validations may involve checking tax rates based on HSN codes, exemptions, and other applicable rules.

Place of Supply Validation: The place of supply determines the jurisdiction in which the GST is levied. Validating the place of supply helps ensure that the correct tax jurisdiction and tax rates are applied.

Reverse Charge Mechanism (RCM) Validation: Under certain circumstances, the recipient of goods or services becomes liable to pay GST instead of the supplier. Validating the applicability of reverse charge mechanism provisions is essential for compliance.

Unit Quantity Code (UQC) (Unit of Measurement): UQC is a measuring quantity under the GST system for a standard use by all taxpayers. Its application is found not only on the GST portal but also in e-way bills and e-Invoicing systems. Hence, it is important for GST registered taxpayers who are into supply of goods.

This simplifies GST-related tasks for Ginesys and EaseMyGST customers, ensures compliance with regulations, and improves the efficiency and accuracy of financial processes. It enables businesses to save time, reduce manual errors, and have a clear view of their GST liabilities.

If your business could benefit from getting automated GST filings and validation of GST data through software, please get in touch now and we may be able to help with a GST data connector for your ERP.