How EaseMyGST Simplifies GST Compliance Beyond Return Filing

GST compliance today goes far beyond filing monthly or quarterly returns. It is about maintaining data accuracy, protecting cash flow, ensuring audit readiness, and managing compliance in an increasingly complex and digitized ecosystem.

Most businesses do not struggle because of GST rates or laws. They struggle because GST compliance depends on scattered data, manual checks, vendor-related errors, and late-stage mismatches that surface only after filings or during audits.

When sales data, purchase data, reconciliations, vendor compliance, filings, and communication exist in silos, errors become inevitable. This is where integrated GST software plays a critical role. It creates a single source of truth, connecting all GST-related processes into one seamless workflow.

This article explores why modern businesses need more than a basic return-filing tool and how platforms like EaseMyGST (EMG) are redefining GST compliance through automation, intelligence, and integration.

1. Clean, Consistent, and Error-Free Invoice Data

Almost every major GST issue—whether it is loss of eligible Input Tax Credit (ITC), mismatched tax liability, or delayed filings—can be traced back to one root cause: poor or inconsistent invoice data.

For retailers, distributors, and multi-branch organizations, data fragmentation is common. Transaction data flows in from multiple systems such as:

- ERP systems

- POS platforms

- Logistics portals

- Vendor systems

- Excel-based teams

Each source follows different formats, rules, and validation logic. As a result, invoice details frequently fail to match, creating a classic “garbage in, garbage out” problem where small errors snowball into major compliance risks.

An integrated GST software acts as a data gatekeeper between your internal systems and the GST portal, ensuring invoices are validated before filing.

How integrated software helps:

- Standardizes invoice formats at the source

- Detects missing or invalid mandatory fields

- Flags mismatches in GSTIN, HSN, invoice dates, and taxable values

- Identifies duplicate invoices

- Syncs directly with ERP/POS systems to eliminate manual entry

Clean data is not just a benefit—it is the foundation of accurate filings, smooth reconciliation, and maximum ITC utilization.

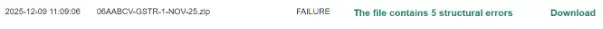

EaseMyGST (EMG) categorizes data issues into:

- Structure Errors: File format issues, missing mandatory fields, invalid JSON/CSV structures

- Business Errors: Incorrect GSTINs, HSN mismatches, tax calculation errors, or invalid document details

2. Automated Reconciliation That Truly Saves Time

Many businesses still rely on manual GST reconciliation, a process that is time-consuming, inefficient, and highly error-prone. It typically involves downloading multiple reports from the GST portal, converting JSON files into Excel, and manually comparing thousands of rows to identify mismatches.

This approach is no longer sustainable due to increasing data complexity driven by:

- GSTR-2B–based ITC rules

- IMS-driven reconciliation requirements

- Frequent supplier amendments

- Monthly vendor changes

- E-invoice vs sales data mismatches

Manual reconciliation cannot keep pace with this complexity and often results in missed or delayed ITC claims.

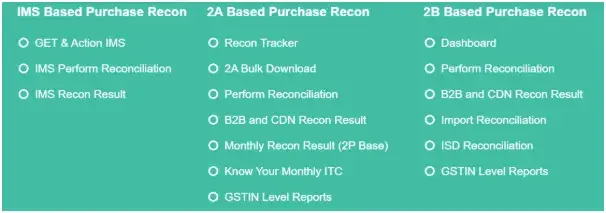

Integrated reconciliation transforms the process by:

- Pulling GSTR-2A and 2B data directly from GSTN

- Using AI and fuzzy logic to match mismatched invoices

- Auto-cross-checking sales, e-invoice, and e-waybill data

- Identifying invoices impacting current-period ITC

- Providing vendor-level insights into missing, duplicate, or amended invoices

A reconciliation cycle that used to consume 3–5 days of finance team effort can now be completed in minutes with far superior accuracy. For businesses, this translates to fewer filing delays, a drastic reduction in clerical errors, and significantly higher ITC optimization by capturing every eligible rupee.

3. A Centralized Compliance Hub

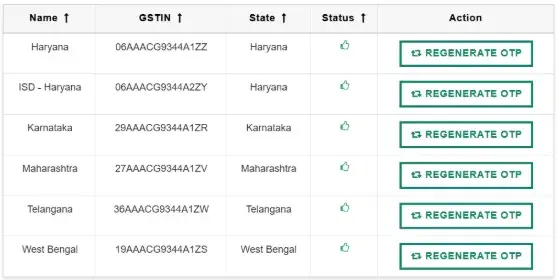

For growing enterprises, GST compliance often becomes fragmented and chaotic—especially when managing multiple GSTINs across various states, overseeing a network of warehouses and retail outlets, or handling distinct corporate divisions.

When different teams process different returns and each GSTIN faces unique challenges, decision-makers lose the real-time visibility they need.

An integrated solution eliminates these silos by establishing a single command center for your entire GST footprint. It aggregates data from every branch and division into one unified view. This centralization empowers businesses to:

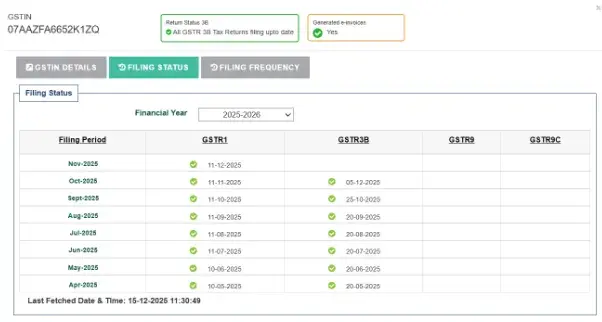

- Monitor Filing Status: Track the real-time status of every GSTIN from a single location.

- Oversee Regional Actions: Identify and address pending tasks across all states simultaneously.

- Standardize Workflows: Implement consistent compliance processes across the entire organization.

- Ensure Data Integrity: Maintain high standards of consistency in data preparation.

- Mitigate Risk: Avoid missed deadlines caused by scattered ownership or communication gaps.

Instead of chasing teams for updates through endless email chains, finance leaders can access a unified dashboard. This provides a comprehensive overview of filings, reconciliation statuses, mismatch reports, and government communications. This level of control and visibility is simply impossible to achieve using manual spreadsheets or disconnected tools.

4. Strengthening GST Defence Through Vendor Compliance Monitoring

Under the current GST framework, the compliance behaviour of your suppliers is directly and dynamically linked to the financial health and stability of your business. This dependency is an unavoidable aspect of the Input Tax Credit (ITC) mechanism. Your ability to claim the full ITC—one of the most critical tools for cash flow optimization under GST—is only as strong as your vendors’ compliance status and timely filing, even if your internal invoice data is captured, validated, and filed with complete accuracy.

If a supplier fails to comply, your ITC is immediately put at risk, creating a serious and entirely preventable financial exposure.

If a vendor:

- Fails to upload invoices

- Delays return filing

- Reports incorrect values

- Becomes inactive or blocked

These compliance lapses create a direct cash flow risk, as tax authorities may require reversal of the claimed ITC along with applicable interest. This is why businesses need a proactive, continuous vendor monitoring system, rather than relying solely on manual, month-end reconciliation.

Integrated GST software addresses this by:

- Monitoring vendor filing status (GSTR-1, GSTR-3B, GSTR-2B)

- Identifying non-compliant vendors

- Flagging high-risk suppliers

- Providing invoice-level visibility

- Automatically sending reminders for missing invoices

Vendor compliance monitoring is no longer a “nice-to-have” administrative function. It is the critical difference between confidently claiming full, defensible ITC and facing avoidable cash outflows, interest liabilities, and prolonged disputes with tax authorities.

5. Faster Payment Cycles Through Automated Customer and Vendor Reminders

For many GST teams, the critical process of resolving data errors still relies on slow, inconsistent, and manual communication. Teams spend significant time emailing customers and vendors about issues such as:

- Missing invoices

- Incorrect invoice details

- Rejected entries

- Required amendments

This manual approach is inherently inefficient and directly delays payment collections. When an invoice contains a compliance error, customers often withhold payment until their ITC eligibility is confirmed, creating avoidable cash flow bottlenecks.

Integrated GST software automates the entire communication workflow.

It helps businesses by:

- Sending automated follow-ups

- Issuing invoice-wise reminders

- Sharing reconciled reports with vendors

- Improving customer billing accuracy

- Reducing disputes and payment delays

Automated communication does more than improve administrative efficiency. It strengthens business relationships, accelerates cash collections, and ensures that isolated GST issues do not escalate into significant financial problems for either your business or your trading partners.

6. Audit-Ready Records Without Last-Minute Scrambling

GST audits and regulatory scrutiny often trigger panic within organizations. This typically happens because, when an audit notice arrives, critical documents are scattered across physical files and multiple digital systems, vendor follow-ups are slow, and unresolved reconciliation gaps resurface under official pressure.

Integrated GST software eliminates this uncertainty by transforming audit preparedness from a reactive scramble into a standard operating practice. It keeps your business audit-ready by default through a centralized, indexed, and comprehensive compliance repository.

Key audit-readiness capabilities include:

- Complete invoice trails

- GSTIN-level compliance history

- Detailed amendment logs

- Ready-to-use reports (GSTR-1 vs GSTR-3B, GSTR-2A vs GSTR-2B, mismatch summaries)

- Clear, period-wise compliance summaries

Instead of spending weeks compiling audit documentation, finance teams can respond to tax authority queries within minutes. Audit readiness becomes proactive and continuous rather than reactive and stressful.

7. How EaseMyGST Makes Compliance Effortless

EaseMyGST (EMG) is a modern GST automation platform designed to go far beyond basic return filing. It delivers a comprehensive and intelligent compliance ecosystem that minimizes manual effort and ensures high data accuracy.

Key capabilities include:

- Deep ERP Integration: Seamless connectivity with Tally, SAP, Oracle, Microsoft, and the Ginesys One ecosystem, eliminating manual data handling

- AI-Based Reconciliation: Advanced fuzzy logic and multi-level matching to reconcile invoices even when formats differ

- Bulk Processing: Bulk GSTR-1 filing, e-invoice data pulls, and automated customer/vendor communication across multiple GSTINs

- IMS-Ready Workflows: Full alignment with the latest government IMS rules, including acceptance, rejection, pending actions, and regenerated GSTR-2B

- Custom Reports and Dashboards: PAN-level, GSTIN-level, and vendor-level visibility supported by advanced analytics

EaseMyGST combines automation, intelligence, and deep system integration to deliver a compliance platform that scales with business growth—without the need for constant manual intervention.

GST Software Is No Longer Optional — It Is Core Operational Infrastructure

The GST environment has matured. Data volumes are higher, compliance rules are stricter, risks are greater, and timelines are tighter. Filing returns alone is no longer sufficient.

Modern businesses need systems that:

- Clean and validate data

- Prevent mismatches

- Monitor vendor compliance

- Automate reconciliation

- Simplify filings

- Maintain continuous audit readiness

Integrated GST software enables:

- Speed

- Control

- Visibility

- Accuracy

- Future-ready compliance

As the GST framework continues to evolve digitally and regulatorily, businesses that invest in integrated, automated GST solutions today will remain compliant, confident in their tax positions, and protected from penalties and unnecessary cash outflows in the future.

Key Questions on Modern GST Compliance

1. Why is “clean data” the most critical foundation for GST compliance?

Clean data is essential because almost every major GST issue—including ITC loss, filing mismatches, and penalties—originates from inconsistent or inaccurate invoice data. Integrated GST software standardizes data from multiple sources such as ERPs, POS systems, and spreadsheets, validating it before filing and preventing minor errors from turning into major compliance risks.

2. How does integrated GST software significantly reduce reconciliation time?

It replaces manual spreadsheet-based reconciliation with direct API-based data pulls from the GSTN (GSTR-2A and GSTR-2B). Using AI and fuzzy logic, the system automatically matches invoices—even with formatting differences—reducing reconciliation cycles from several days to just minutes.

3. Why must businesses monitor vendor GST compliance even when internal data is accurate?

ITC eligibility depends on vendors filing their returns correctly and on time. If a vendor delays filing or reports incorrect values, the buyer’s ITC is immediately impacted. Integrated GST software continuously tracks vendor filing status (GSTR-1 and GSTR-3B), flags high-risk suppliers, and helps safeguard cash flow and compliance.

4. How does a centralized compliance hub help multi-state businesses beyond return filing?

A centralized hub consolidates data from all GSTINs into a single dashboard, eliminating silos. It provides real-time visibility into filings, pending actions, and mismatches across states, while standardizing workflows and preventing missed deadlines caused by decentralized ownership.