GSTIN Verification - Now Smarter with EaseMyGST for Ginesys Cloud ERP

GST compliance begins much before return filing.

It starts at the point where a GSTIN is captured, stored, and used across invoices, masters, and transactions.

A single incorrect GSTIN may not stop billing immediately, but it silently creates downstream risks — ITC mismatches, reconciliation failures, and avoidable GST notices. For growing retail and distribution businesses, GSTIN accuracy is no longer a clerical task. It is a core compliance control.

With the latest enhancement, Ginesys Cloud ERP now offers smarter GSTIN verification through deep integration with EaseMyGST. This update transforms GSTIN validation from a manual checkpoint into an automated, system-driven safeguard.

Why GSTIN Verification Is Critical in GST Compliance

GSTIN is not just an identifier.

It defines the legal identity, registration status, and tax eligibility of a business.

Every outward invoice, inward ITC claim, and reconciliation process depends on the accuracy of GSTIN data. When GSTINs are incorrect, inactive, or cancelled, the impact is felt much later — usually when correction windows are closed.

Incorrect GSTINs typically lead to:

- ITC denial for customers

- GSTR-1 and GSTR-2B mismatches

- Reconciliation failures with GSTN

- GST notices seeking explanation

- Manual rework across past periods

Most of these issues originate at the master data level, not during return filing.

Compliance failures usually begin with data entry errors.

The Challenge with Traditional GSTIN Validation

In most ERP environments, GSTIN validation is either manual or superficial. Teams rely on visual checks or one-time validation during onboarding, assuming the data remains correct indefinitely.

This approach fails in real-world scenarios.

GST registrations change status frequently. Businesses may get cancelled, suspended, or amended without immediate visibility to their counterparties. A GSTIN that was valid last month may not be valid today.

Manual processes cannot:

- Track real-time GSTIN status changes

- Validate GSTINs at transaction level

- Prevent billing on inactive registrations

- Ensure continuous compliance

As transaction volumes scale, these gaps turn into systemic risks.

GSTIN Verification — Now Smarter in Ginesys Cloud ERP

To address this challenge, Ginesys Cloud ERP has introduced enhanced GSTIN verification powered by EaseMyGST.

This integration brings real-time, API-driven GSTIN validation directly into the ERP workflow, ensuring GSTIN accuracy is enforced at the point of use rather than after errors occur.

The objective is simple.

Prevent incorrect GSTINs from entering the system in the first place.

What’s New in the GSTIN Verification Enhancement

The latest update introduces intelligent validation checks that work seamlessly within the Ginesys Cloud ERP environment.

Instead of treating GSTIN verification as a static check, the system now validates GSTINs dynamically using EaseMyGST’s compliance engine.

Key improvements include:

- Real-time GSTIN status validation

- Automatic verification during master creation and updates

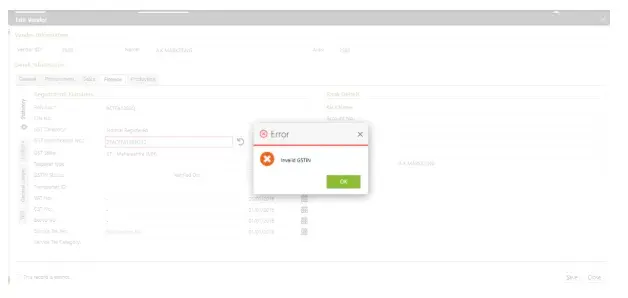

- Detection of inactive, cancelled, or invalid GSTINs

- Reduction in manual checks and dependency on external portals

This ensures GSTIN accuracy across customers, vendors, and transactions.

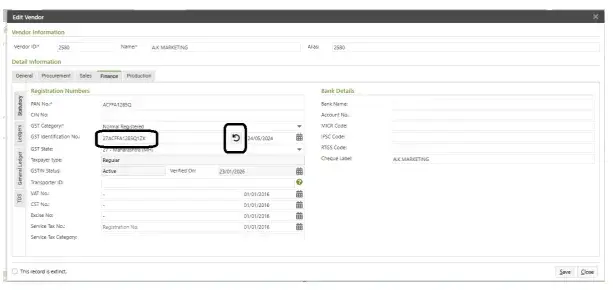

How GSTIN Verification Works Inside Ginesys Cloud ERP

The verification process is designed to be simple for users while powerful in the background.

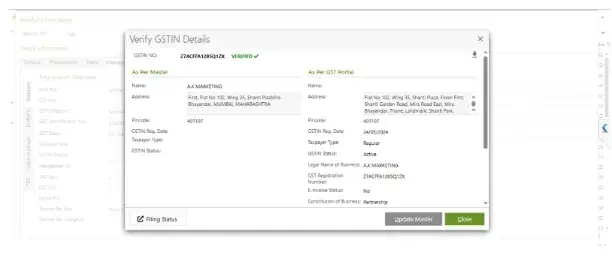

When a GSTIN is entered or modified in the ERP, the system automatically triggers validation through EaseMyGST. The response is fetched directly from GSTN-compliant sources and reflected within the ERP interface.

The system checks for:

- GSTIN structure and format

- Registration status (Active / Cancelled / Suspended)

- Legal name consistency

- State code alignment

Invalid or inactive GSTINs are flagged immediately, allowing corrective action before transactions are processed.

Compliance is enforced at the source, not corrected later.

Why Real-Time GSTIN Validation Matters

GST compliance is time-sensitive.

Errors detected late are harder and costlier to fix.

Real-time GSTIN validation ensures that only compliant data flows into invoices, returns, and reconciliations. This drastically reduces downstream exceptions and post-filing corrections.

With continuous validation:

- ITC mismatches are prevented

- Customer disputes are minimized

- Reconciliation becomes predictable

- Audit exposure is reduced

It shifts GST compliance from reactive to preventive.

Impact on Billing and Invoicing Accuracy

GSTIN accuracy directly affects invoice validity. An invoice issued with an inactive or incorrect GSTIN may result in ITC denial for the recipient, even if tax is paid correctly.

By validating GSTINs within Ginesys Cloud ERP, businesses ensure that invoices generated are compliant from a GST perspective.

This improves trust with customers and reduces follow-ups related to ITC issues.

Correct GSTINs protect both sides of the transaction.

Benefits for Finance and Compliance Teams

For finance and compliance teams, this enhancement eliminates a significant operational burden.

Manual GSTIN checks consume time and are prone to oversight. With automated validation embedded in the ERP, teams can focus on exception handling rather than routine verification.

Key benefits include:

- Reduced manual intervention

- Fewer reconciliation discrepancies

- Improved data reliability

- Faster month-end closure

- Stronger audit readiness

Compliance becomes a system capability, not a team dependency.

Integration with EaseMyGST: A Strategic Advantage

EaseMyGST brings deep GST intelligence into the ERP ecosystem. Its validation engine is designed specifically for Indian GST compliance, making it reliable and scalable.

The integration ensures that GSTIN verification is not an isolated feature but part of a broader compliance framework that includes return filing, reconciliation, and audit reporting.

When ERP and GST compliance platforms work together, data integrity improves across the entire lifecycle.

Why This Matters for Growing Businesses

As businesses expand across states, channels, and partners, GST complexity increases exponentially. Managing GSTIN accuracy manually does not scale.

This enhancement is especially valuable for:

- Retail chains with multi-location customers

- Distributors handling large dealer networks

- Enterprises with high transaction volumes

- Businesses operating across multiple states

Automated GSTIN verification ensures consistency, regardless of scale.

Compliance Is Moving Upstream

GST compliance is no longer limited to filing returns correctly. Regulators expect businesses to maintain accurate, validated data throughout their systems.

This shift makes ERP-level controls essential.

By embedding GSTIN validation directly into Ginesys Cloud ERP, businesses move compliance upstream — where errors are cheapest to fix and easiest to prevent.

Conclusion

GSTIN verification may appear like a small step, but its impact on GST compliance is significant. Incorrect GSTINs are one of the most common root causes of ITC disputes and reconciliation failures.

With smarter GSTIN verification powered by EaseMyGST, Ginesys Cloud ERP strengthens compliance at the foundation level. Businesses benefit from cleaner data, fewer errors, and greater confidence in their GST processes.

In a compliance-driven environment, accuracy is not optional.

Smarter GSTIN verification is no longer a feature. It is a necessity.