Types of Invoice Reporting in GST Filing

Accurate invoice reporting is the foundation of correct GST filing. Under India’s GST framework, every tax liability, Input Tax Credit (ITC) claim, and reconciliation process is directly linked to how invoices are classified and reported.

A single invoice-level error may appear minor, but once it enters the GST ecosystem, it can create mismatches across returns — often detected months later.

GST is not a return-driven system.

It is an invoice-driven compliance mechanism.

Every invoice you issue flows into GSTR-1, reflects in your customer’s ITC eligibility, and is ultimately reconciled with GSTR-3B and GSTN auto-generated data. When invoices are misclassified or reported in incorrect tables, the system automatically flags discrepancies.

In this blog, we explain:

- Types of invoices under GST

- Where each invoice type must be reported in GSTR-1 and GSTR-3B

- Common invoice reporting mistakes businesses make

- How automation platforms like EaseMyGST eliminate compliance risks at scale

Why Invoice Classification Matters in GST

GST compliance today goes beyond timely tax payment. It requires:

- Accurate reporting

- Data consistency across returns

- Audit readiness

Each invoice type defined under the GST law corresponds to a specific reporting table. Errors occur not because tax is unpaid, but because data does not align across returns, systems, and counterparties.

Incorrect invoice classification typically results in:

- Mismatch between GSTR-1 and GSTR-3B

- ITC denial or delays for customers

- Reconciliation gaps with GSTN auto-populated data

- GST notices seeking clarification

- Increased audit and compliance exposure

For businesses processing thousands of invoices each month, even a minor classification error can escalate into a major compliance issue.

GST systems rely on data—not intent.

Understanding GSTR-1 and GSTR-3B Before Invoice Reporting

Before reviewing invoice types, it is essential to understand how GST returns interact.

GSTR-1 – Statement of Outward Supplies

GSTR-1 captures invoice-level details of all outward supplies. This data is shared with GSTN and becomes the basis for your customer’s ITC eligibility. Any error here directly impacts your customers and often leads to disputes.

GSTR-3B – Summary Return

GSTR-3B is a summary declaration of tax liability and ITC. While it does not capture invoice-level data, GSTN continuously reconciles it with GSTR-1 and other system-generated statements.

Even if tax is paid correctly in GSTR-3B, incorrect reporting in GSTR-1 still leads to mismatches.

Tax payment alone does not ensure compliance—accurate reporting does.

Types of Invoices and Their GST Reporting

Below is a clear explanation of each invoice type and its correct reporting under GST.

1. Tax Invoice

A tax invoice is issued for taxable outward supplies under GST and applies to both B2B and B2C transactions. GST reporting treats these invoices differently based on whether the recipient has a valid GSTIN.

Reporting of Tax Invoices

In GSTR-1:

- B2B invoices → Table 4

- B2C Large invoices → Table 5

- Export invoices → Table 6A

- B2C Small invoices → Table 7

In GSTR-3B:

- Taxable outward supplies → Table 3.1(a)

A common mistake is classifying B2C invoices as B2B based on customer size or relationship. Under GST, classification depends only on the presence of a valid GSTIN.

Misclassification leads to ITC mismatches and downstream reconciliation issues.

2. Bill of Supply

A bill of supply is issued when GST is not charged, such as for:

- Exempt supplies

- Nil-rated supplies

- Supplies by composition dealers

Although no tax is charged, these transactions must be reported.

Reporting of Bill of Supply

In GSTR-1:

- Nil-rated, exempt, and non-GST supplies → Table 8

In GSTR-3B:

- Exempt and nil-rated supplies → Table 3.1(c)

A common misconception is that non-taxable supplies do not require reporting. Missing these entries distorts turnover figures and increases audit risk.

No tax does not mean no reporting.

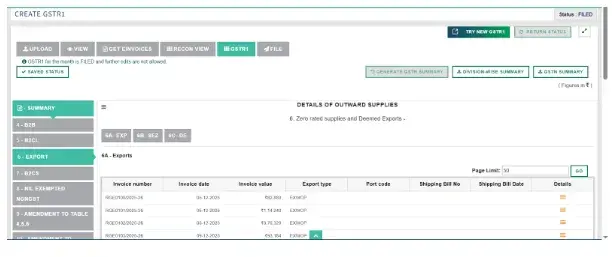

3. Export Invoice

Export invoices apply to supplies made outside India. Under GST, exports are treated as zero-rated supplies, not exempt supplies.

Exports can be made:

- With payment of tax

- Without payment of tax under LUT

Reporting of Export Invoices

In GSTR-1:

- All export invoices → Table 6A

In GSTR-3B:

- Export with payment of tax → Table 3.1(a)

- Export without payment of tax → Table 3.1(b)

Incorrectly reporting exports as exempt supplies affects refund eligibility and delays processing. Export reporting must be precise, as refunds are entirely system-driven.

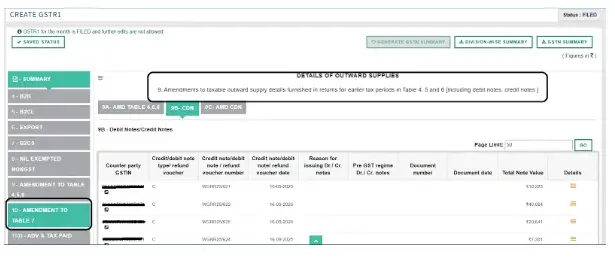

4. Credit Note

A credit note is issued to reduce the value or tax of a previously issued invoice due to:

- Sales returns

- Post-sale discounts

- Pricing corrections

Reporting of Credit Notes

In GSTR-1:

- Credit notes (B2B and B2C) → Table 9B

In GSTR-3B:

- Adjusted against outward tax liability in Table 3.1

A frequent error is adjusting tax in GSTR-3B without reporting the corresponding credit note in GSTR-1—leading to immediate reconciliation mismatches.

5. Debit Note

A debit note is issued when the taxable value or tax charged earlier was insufficient, due to:

- Additional charges

- Revised pricing

- Tax corrections

Reporting of Debit Notes

In GSTR-1:

- Debit notes → Table 9B

In GSTR-3B:

- Included in taxable outward supplies → Table 3.1(a)

Ignoring debit notes leads to under-reporting of tax liability, interest exposure, and penalties.

6. Revised Invoice

A revised invoice is issued to correct errors in an earlier invoice, usually due to changes in registration or invoice details.

Revised invoices replace the original invoice data in GST systems.

Reporting of Revised Invoices

In GSTR-1:

- Original invoice details replaced with revised data

Impact on GSTR-3B:

- Tax liability adjusts automatically through reconciliation

Revised invoices must be properly linked and traceable. Poorly structured revisions often fail GSTN validation.

7. Self-Invoice under Reverse Charge Mechanism(RCM)

Under RCM, the recipient is liable to pay GST and must issue a self-invoice.

Reporting of RCM Invoices

In GSTR-1:

- Not applicable

In GSTR-3B:

- Tax payable under RCM → Table 3.1(d)

- ITC claimed on RCM → Table 4(A)

RCM requires reporting both tax liability and ITC. Missing either side creates reconciliation imbalances and audit flags.

Common Invoice Reporting Mistakes Businesses Make

Despite clear GST rules, invoice-related errors remain common—especially in manual processes.

Most frequent mistakes include:

- Reporting B2C invoices as B2B

- Missing credit or debit notes in GSTR-1

- Incorrect Place of Supply (POS)

- Mismatch between GSTR-1 and GSTR-3B

- Duplicate invoice numbers or broken series

- Incorrect tax rates or HSN codes

These errors often surface during audits or customer follow-ups—when correction windows have already closed.

Why Manual Invoice Reporting Is No Longer Sustainable

As invoice volumes increase, manual validation becomes unreliable. Human review cannot consistently verify:

- GSTIN accuracy

- Tax rates and POS rules

- Invoice series integrity

- Return-level reconciliation

Manual processes focus on post-filing corrections instead of pre-filing accuracy. Modern GST compliance requires preventive controls, not reactive fixes.

How EaseMyGST Simplifies Invoice Reporting

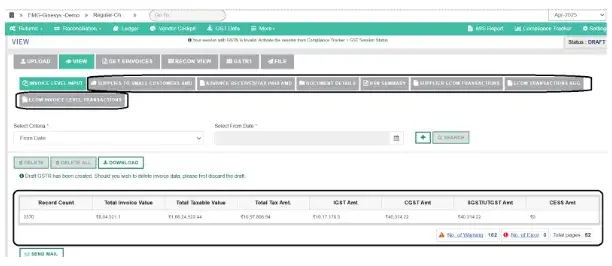

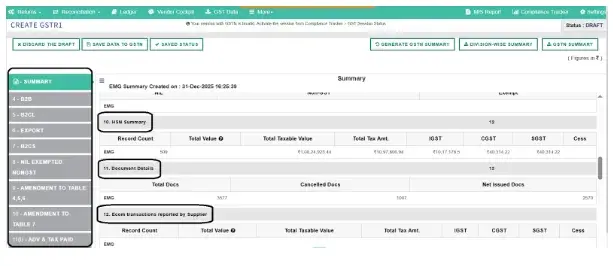

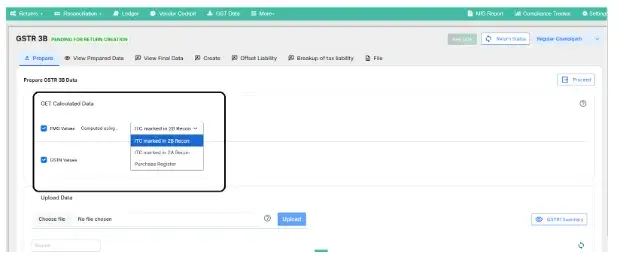

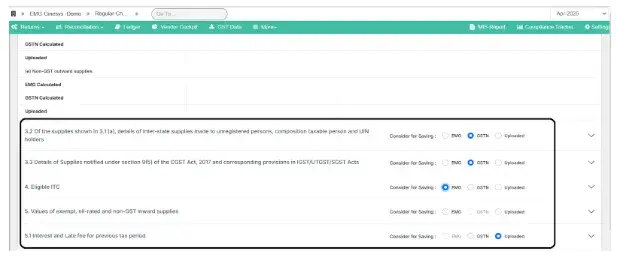

EaseMyGST eliminates GST complexity by validating invoice data before filing. Instead of fixing errors later, EaseMyGST prevents them at the source.

What EaseMyGST Automates:

- Auto-classification of invoice types

- GSTIN, POS, HSN, and tax rate validation

- Invoice series and duplication checks

- Real-time GSTR-1 vs GSTR-3B reconciliation

- Audit-ready compliance reports

EaseMyGST integrates seamlessly with leading ERP and POS systems such as Ginesys, SAP, and Tally, ensuring a single source of truth.

Why ERP-Integrated GST Compliance Matters

Disconnected systems create compliance blind spots.

When ERP, billing, and GST filing platforms operate on the same data:

- Invoice errors are detected early

- Reconciliation becomes continuous

- Compliance becomes predictable and scalable

Integration-driven compliance reduces risk, effort, and manual intervention.

Final Thoughts

Understanding invoice types and their correct reporting is fundamental to GST compliance. As GST systems become increasingly data-driven, invoice-level accuracy determines compliance outcomes.

Manual processes may work at low volumes—but they do not scale safely.

With automation platforms like EaseMyGST, businesses gain accuracy, control, and confidence across the entire GST filing lifecycle—from invoice creation to final reconciliation.

Stay compliant. Stay automated. Choose EaseMyGST.